Startup & Unicorn Growth Valuation

Abstract

How do you value companies which have IPOed recently? How do you compare them amongst their peers? Valuing companies using a linear extrapolation of their revenues and profits leads to an ingenious method to benchmark stocks against each other. Here we present such a method, dubbed the growth average U1. The Appendix includes MySQL code to calculate the extrapolation insitu and a list of Top10 tables for various MarketCaps.

Section 1 - Introduction

Valuing a startup and young company is often difficult. Especially if they are expanding so fast such that their cash burn is faster than their profits. This is usually the case for SaaS (Software as a Service) or NaaS (Network as a Service) companies that prioritize their expansion over the initial profits, usually offering their services or products at below cost prices in order to grow their customer base and in order to displace any pre-existing competitors out of the market or grab market share from them. This can not only be said about SaaS/NaaS firms but essentially applies to any company trying to establish themselves in the market place, take for example Amazon, Netflix etc.

When the stock has IPOed you can look at snapshots of their ratios such as Price to Sales (P2S) or Price to Earnings (PE) Ratios (provided earnings are positive), and if the company hasn’t IPOed you will look at revenue, sales, number of customers. In particular, you would want to measure the growth of these figures in order to predict what a future value of the firm would be. You would infer from the revenue a market capitalization comparing them to other companies in the sector or industry with the average or maximum P2S (or PE).

One such method is the ‘Rule of 40’ [1, 2] which states that growth rate and profit margin together should exceed 40%. It is used as a quick method to gauge if a stock is attractive or not. Jim Cramer [3] suggested a modified version even that requires this percentage amount to be more than 5 times larger than its P2S.

This Rule of 40 is essentially a sum of two growth percentages. The revenue growth and the profit margin. The profit margin is the ratio of profit over revenues. It isn’t quite comparable in nature to the revenue growth since the profit margin is essentially an amount at the product level and increases by multiples of the number of products sold. A company with a small profit margin but a huge number of sales can grow faster than a company with a much bigger profit margin but a small number of sales. This Rule of 40 therefore is not perfect. But it is a quick and dirty way to come up with a mechanical rule to compare companies where you have negative earnings and only a few data points to work with.

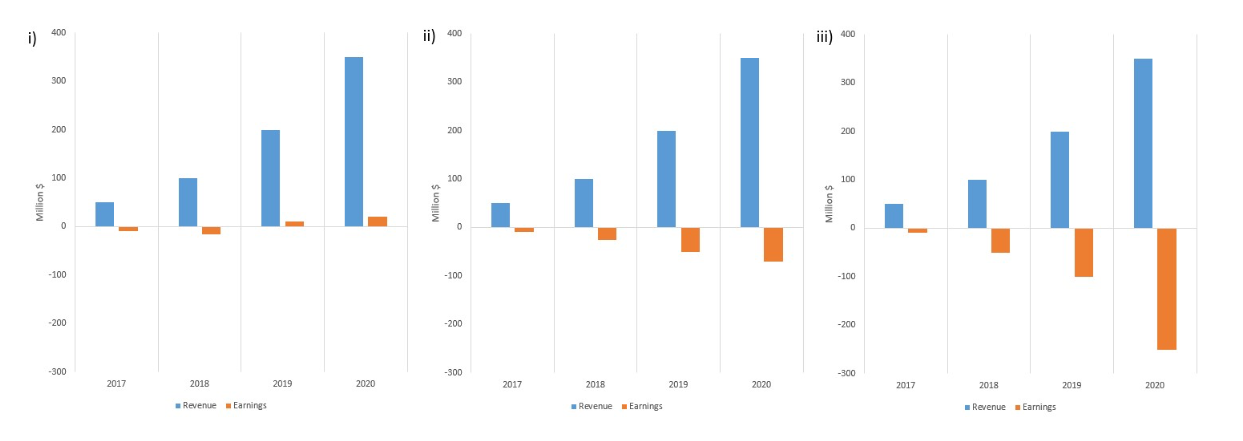

Section 2 - Average Growth = U1

Here we aim to come up with a better, more accurate method for valuing such companies. When you follow stocks that have IPOed only recently and that have a strong price trend they all have something in common when you look at their financials (See Figure 1 Typical Revenue and Earnings). They have a revenue growth that looks extraordinarily strong and often times an earnings growth that is a small negative at best (i) or declining steadily/rapidly at worst (ii and iii). From looking at the earnings and revenue rising/declining, what is the best way to gauge if it’s a healthy or weak growth. Similar to the Rule of 40 you would calculate what the growth of revenue is.

Figure (1) Typical Revenue and Earnings

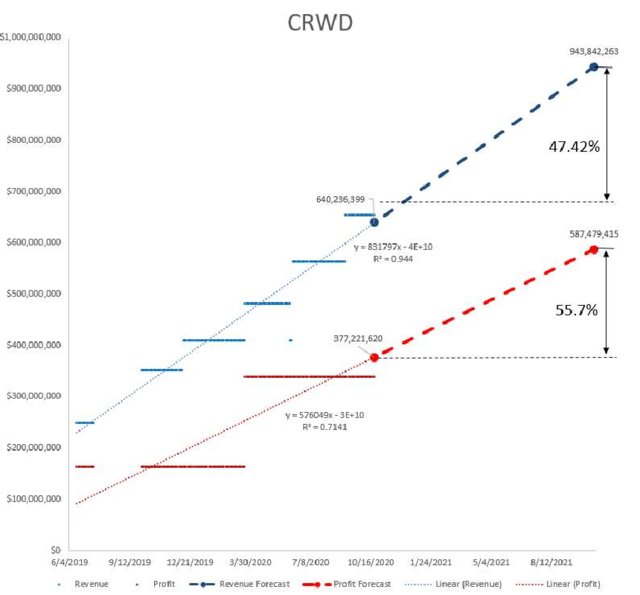

A perfect way to track the total revenue and gross profit is to use the trailing twelve month running values. Using a trailing twelve-month figure eliminates any seasonality effects which is an advantage already. Looking at an example of these numbers for a stock (CRWD - Crowdstrike) in Figure 2: Total Revenue (TR) and Gross Profit (GP) of CRWD below you notice that the total revenue gets updated at more or less quarterly values and the gross profit every six months. This might vary from stock to stock or release to release. The jump from one level to the next is the amount of growth they have achieved in this period. How do you calculate the annual growth estimate from that? The best way to do this is to calculate a linear regression through the data points, which is indicated by the blue and red dotted lines in Figure 2. Linear regression optimizes the error around fitting a line through the data points. As a result, we get a slope ‘m’ and a constant ‘b’, representing the intersection with the y-axis, which is all is needed to define a line through the data points. From the definition of this line it is trivial to extrapolate it out one year and derive the annual % growth value of total revenue and gross profit likewise.

Formulas for ‘m’ and ‘b’ can be found in any undergraduate math book, but a readymade function to calculate this directly in a database using standard commands does not exist. But as it turns out it is doable directly in the database without having to outsource this operation to another programming language. We have listed these neat lines of our code for calculating the linear extrapolation in Appendix 1 since we believe users will find this useful in the future.

There is also the question of how long the time window is that you will use to calculate the linear regression. For relatively young companies or startups a period of a maximum of 1-year will be enough to determine the growth. In any case using the twelve month running totals means with a 1-year range you are effectively covering a 2-year period already. Why don’t we use longer time windows? Essentially using a much longer time window means we are looking at a long term growth of a seasoned company. We are going to assume that such growth will be already priced into the stock and what we are looking for is shorter term deviations of price and value. This is why we pick a 250 day period, a bit less than a calendar year.

Figure (2) Total Revenue (TR) and Gross Profit (GP) of CRWD

For our example stock CRWD this is a 47.42% growth of total revenue and 55.7% growth of gross profits. We are going to look at other example stocks to elaborate on this. Figure X2 shows the same chart for FVRR, TSLA, AAPL and FB. While stocks like CRWD and FVRR are examples of startups and possible ‘unicorn’ candidates, it can be argued that stocks like TSLA, AAPL and FB do not fit this moniker anymore. But judging from the growth figures we arrive at interesting conclusions for these 5 stocks.

Table 1 Example Growth Figures shows the derived growth values for total revenue and gross profits and an average of these two. What is noticeable from these example names is that the growth of revenue and growth of profits is of a similar order of magnitude. The gross profits are all positive in these examples also. In general, this might not be the case, there will be companies which have negative profits early on in their history and survive even with negative earnings if they find loans to keep their business afloat. In addition, their revenue growth might be outsizing their decline or growing increase in losses. The growth of gross profits might be negative but the amount of positive growth outweighing the negative growth in earnings. For many investors an increasing loss in earnings is a negative sign, but for some investors it is the net growth of revenue over earnings that counts. They discount the increasing loss in earnings against the outsized growth in revenue. When we calculate the growth values individually we can add the two together in the end and divide by 2, arriving at the average growth. If for example the growth of gross profits (GP) is -20%, but the growth of total revenue (TR) is +50%. The net average growth would be 15%. This is a pragmatic and quite reasonable way to compare the growth values to other companies doing this.

Continue reading and find the full source code for MySQL in the full article published on ResearchGate below: