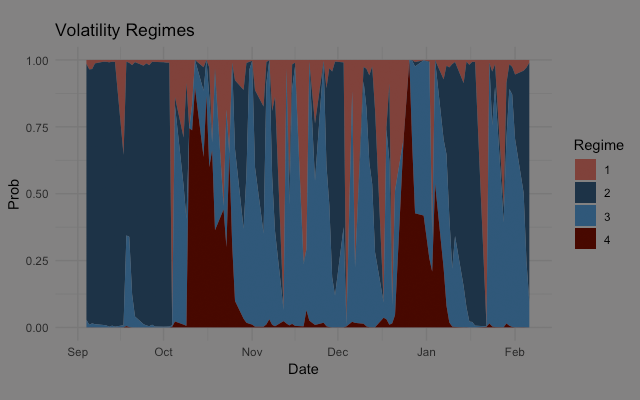

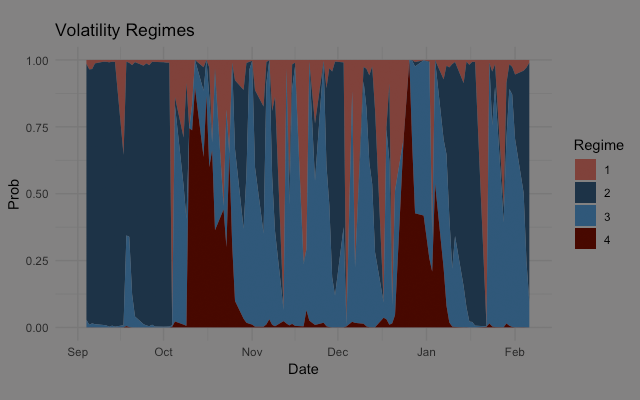

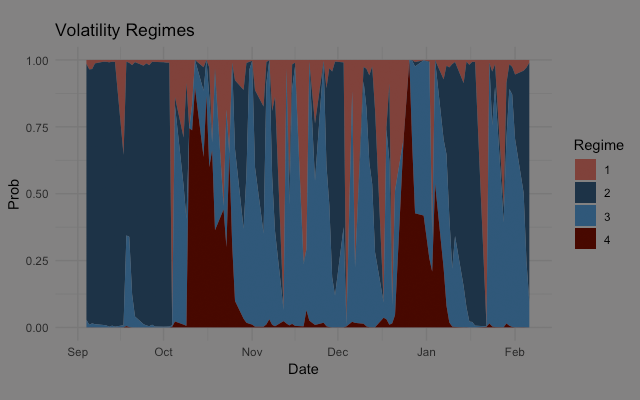

A Gaussian Mixture Hidden Markov Model for the VIX

A Hidden Markov Model (HMM) is used to model the VIX (the Cboe Volatility Index).

A Hidden Markov Model (HMM) is used to model the VIX (the Cboe Volatility Index).

UNISWAP is a decentralized exchange (DEX) and part of an ecosystem of products in decentralized finance (DeFi).

How do you value companies which have IPOed recently?

Feature Article in the Magazine: Technical Analysis of Stocks & Commodities

It's a mechanical trading rule used by many day traders and long term investors.

Trend following is common sense and we use it without knowing daily in our lives.

Explained: Benjamin Graham's formula to forecast the future value of a company based on its earnings history and growth forecasts.

The Hindenburg Omen predicted the crash of 1987 and also triggered many times before the crash of the great financial crisis (GFC) in 2008.

Piotroski only looks at stocks in the lowest third of the market cap population and the highest fifth of the book-to-market population.

If the market were a wristwatch, it would be divided into shares, not hours. (Richard Arms)

Based on the analysis of the conventional Arms Index (TRIN) calculation we have deduced an improved version of the TRIN, which we showcase here.

The McClellan Oscillator was developed by Sherman and Marian McClellan in 1969. It is based on the Advanced-Decline-Line (ADL).

The HILO Index is the difference between the number of new highs and new lows per day

This indicator is a signal for a trend exhaustion. It signals when an underlier is oversold or overbought.

If people trade w.r.t Fibonacci or whether subconsciously the golden ratio affects the objectivity of the people trading is still open for debate.

Feature Article in the Magazine: Technical Analysis of Stocks & Commodities

It's a mechanical trading rule used by many day traders and long term investors.

Trend following is common sense and we use it without knowing daily in our lives.

The Hindenburg Omen predicted the crash of 1987 and also triggered many times before the crash of the great financial crisis (GFC) in 2008.

If the market were a wristwatch, it would be divided into shares, not hours. (Richard Arms)

Based on the analysis of the conventional Arms Index (TRIN) calculation we have deduced an improved version of the TRIN, which we showcase here.

The McClellan Oscillator was developed by Sherman and Marian McClellan in 1969. It is based on the Advanced-Decline-Line (ADL).

This indicator is a signal for a trend exhaustion. It signals when an underlier is oversold or overbought.

The HILO Index is the difference between the number of new highs and new lows per day

If people trade w.r.t Fibonacci or whether subconsciously the golden ratio affects the objectivity of the people trading is still open for debate.

How do you value companies which have IPOed recently?

Explained: Benjamin Graham's formula to forecast the future value of a company based on its earnings history and growth forecasts.

Piotroski only looks at stocks in the lowest third of the market cap population and the highest fifth of the book-to-market population.

A Hidden Markov Model is a Machine Learning Method used in many everyday applications.

UNISWAP is a decentralized exchange (DEX) and part of an ecosystem of products in decentralized finance (DeFi).